charitable gift annuity tax deduction

How to Reduce Your Taxes and AGI by Giving to Charity. Income Gift and Estate Tax Consequences Charitable Deductions.

Charitable Gift Annuity Eternal Food Foundation

However this benefit should be.

. An annuity trust is a trust in which the payments for the duration of the trust either to a private or charitable beneficiary are of a fixed amount. The method of determining the charitable deduction is complicated and is generally stated in Treas. This was not true with the pre-July 1.

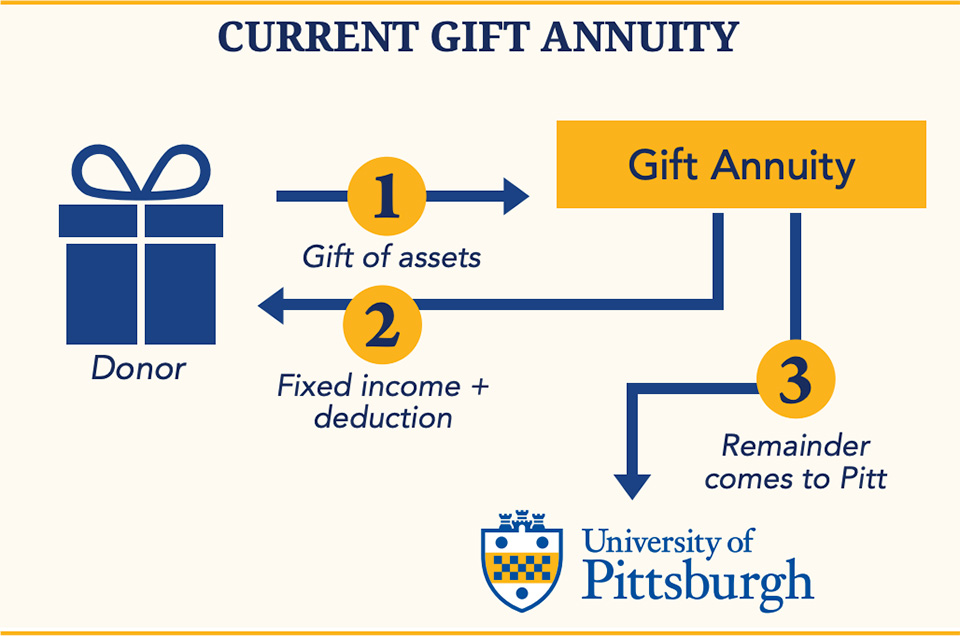

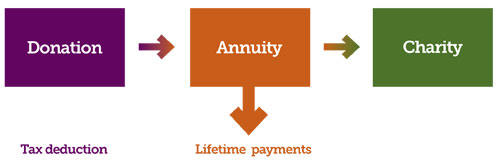

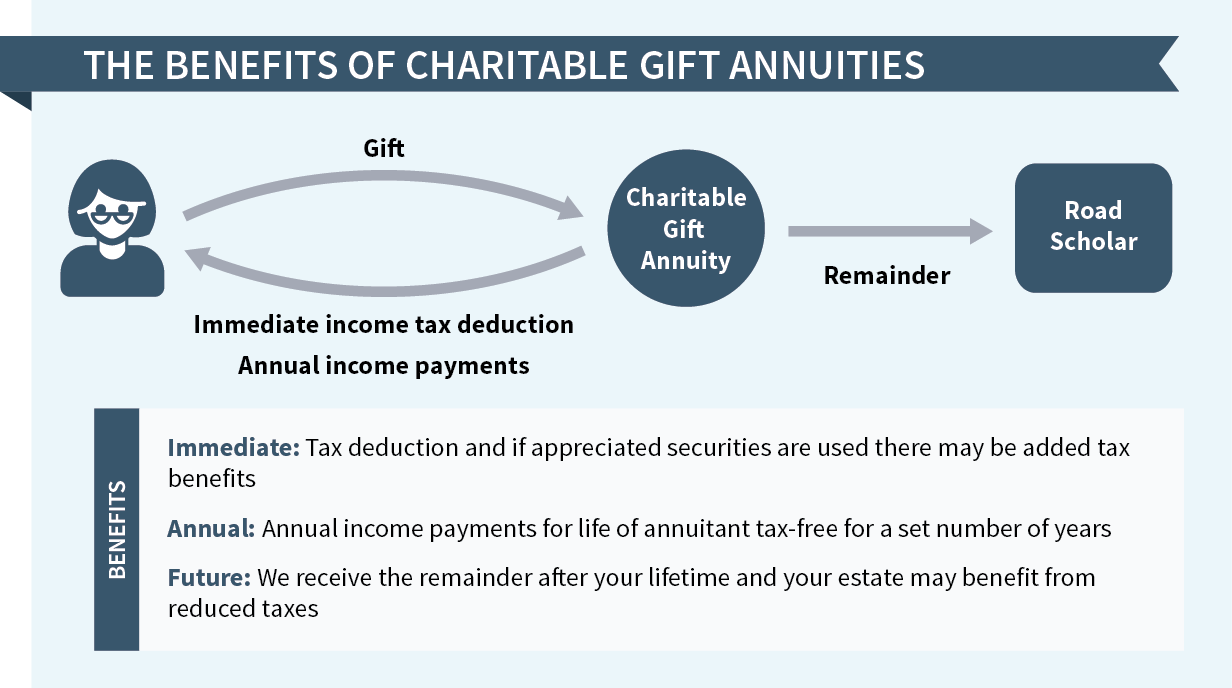

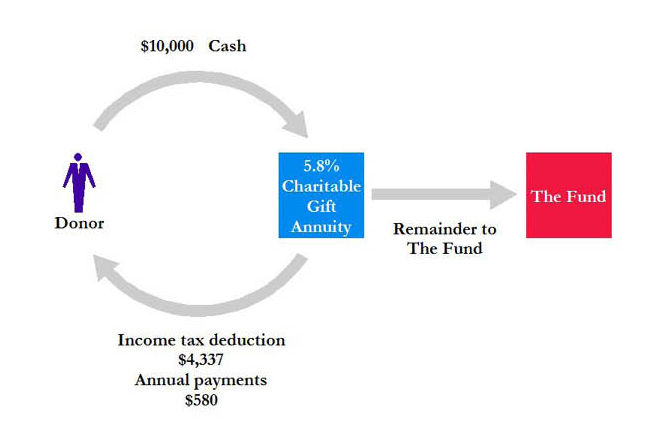

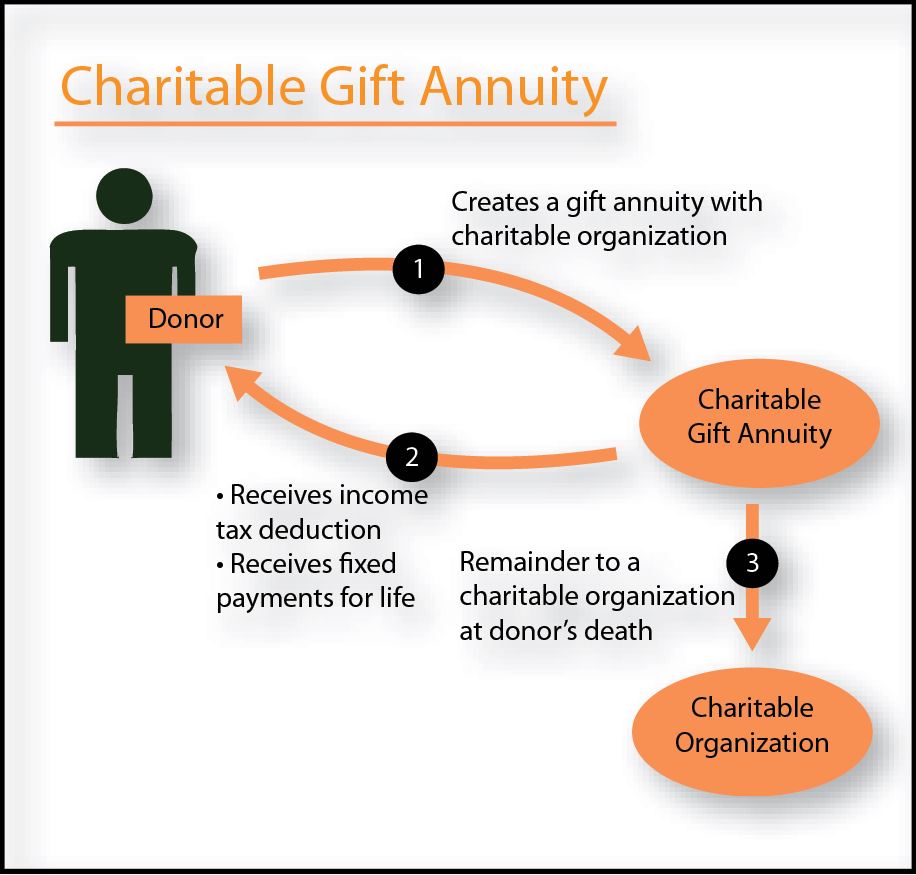

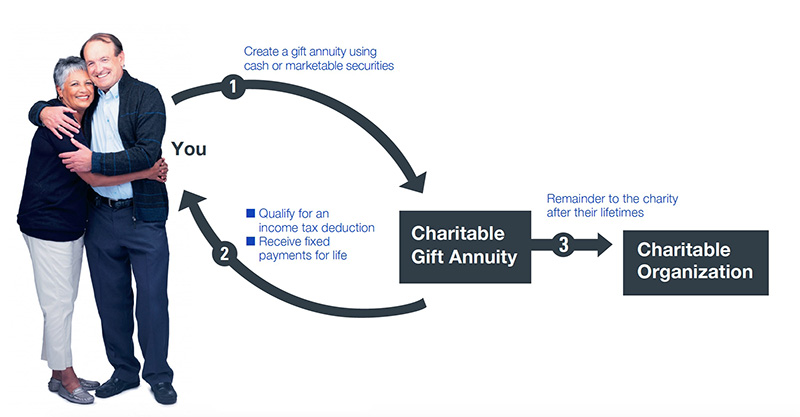

You get a tax break for your charitable gifts if you donate to a qualifying organization and itemize your deductions. There are typically two hurdles to getting an income tax benefit from a charitable deduction. A charitable gift annuity is a contract between a donor and a charity under which the charity in return for the donors gift agrees to pay a fixed amount to the donor and one more individual if the donor chooses for the donors lifetime.

Grantor charitable lead trust. Any relevant capital gains will be taxed at the current owners tax bracket. If it drops in value so will the annuity.

For example if you donate 100000 but can expect to. A gift to a charitable remainder unitrust will qualify for income and gift tax charitable deductions or an estate tax charitable deduction only if the following conditions are met. The National Gift Annuity Foundation offers immediate deferred and flexible gift annuity structures allowing you to meet your lifetime income payment needs.

What Is a Charitable Gift Annuity. In a grantor charitable lead trust the grantor can take an immediate income tax charitable deduction for the present value of the future payments that will be made to the charitable beneficiary subject to applicable deduction limitations depending on whether the beneficiary is a public charity or a private foundation. 2522 allows an unlimited gift tax deduction for a gratuitous transfer of money or property to or for the use of certain charitable entities and for specified purposes.

The surveys include questions related to gifts annuitants administration and investments. 1350 Taxation of Annuity Payments. A Charitable Remainder Annuity Trust CRAT is a type of gift transaction in which a donor contributes assets to a charitable trust which subsequently pays a.

In the case of a charitable remainder unitrust CRUT the value of the contributed property is reduced by the present value of the unitrust interest for a term of years or for the life of the. When the donor dies the charity keeps the gift. 1664-4e3 and 4.

Such payments include the earnings on and a part of the principal in the reserve account. In addition all amounts in the trust for which a charitable contribution deduction was allowed under section 170 for individual taxpayers or a similar section for personal holding companies foreign personal holding companies or estates or trusts including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in. Chapter 3 DeductionsExpenses of a Business 1500 Tax Treatment of Start-Up Expenditures.

1514 Compensation Deduction. Earn protection against creditors for the assets inside the CRT. 1377 Income Realized on Discharge or Cancellation of Debt COD.

By pooling these life income gifts we can create investment compliance administration and risk management efficiencies to maximize the final grants to your favorite charites. Taxable gift of 0 Jane owed no gift tax and did not need to use any of her available gift tax exemption. 1367 Accident and Health Insurance Benefits.

Citizen or resident Sec. This payment does not change during the course of the CRAT hence the description as an annuity. A donor is entitled to a Charitable Deduction based on the present value of the remainder interest in a CRUT.

Earn more income now and throughout your life than you would if you just. The standard deduction for a married couple in 2020 is 24800. The IRS views one portion of your contribution as a gift to be used immediately by the charity for its tax-deductible charitable purposes.

You must have enough deductions to itemize your deductions. A charitable gift annuity is a gift vehicle that falls in the category of planned giving. When an annuity is gifted to another party the transaction triggers a taxable event for the donor.

Why only a partial deduction. The charitable deduction components in Sec. Two exceptions may apply.

Gift tax charitable deduction. It involves a contract between a donor and a charity whereby the donor transfers cash or property to the charity in exchange for a partial tax deduction and a lifetime stream of annual income from the charity. Our Charitable Gift Annuity is one of the easiest ways to establish a plan for giving and provide a lifetime of reliable annuity payments.

The issuing institution guarantees the. Where things get tricky is determining the amount of your deduction. Benefit a charity or charities.

You may be eligible to claim a partial charitable tax deduction for the year in which you set up the charitable gift annuity. How To Maximize Your Tax Deduction. The donors charitable contribution for funding a charitable remainder annuity trust CRAT is the value of the property placed in the CRAT less the present value of the CRATs annuity payments.

That is a portion may be eliminated but the remainder will be deferred By donating assets in-kind you will preserve the full fair market value of the assets rather than reduce it by selling it and paying capital gains taxes. 2055 for an estate tax charitable deduction are quite different from the income tax deduction rules under Sec. Remember that for 2020 the state and local tax deduction eg property taxes for Texans is capped at 10000 for a married couple.

Enjoy an immediate partial tax deduction and set aside dollars for your charitable legacy while receiving a continued stream of investment income. Unique in the gift planning community the American Council on Gift Annuities ACGA. If you do not have.

Annuity calculator. The annuity starting date for purposes of calculating the deferred gift annuity rate will be the same as the annuity starting date for calculating the charitable deduction if payments are at the end of the period which is usually the case. Convert any appreciated asset or assets into something that offers lifetime income.

Charitable deduction to reduce trust income tax liability for a given year. You can take an income tax deduction spread over five years for the value of your gift to the charity. The value of your gift is not simply the value of the property.

And should the gift occur prior to the annuity owners age of 59 ½ the transaction will be subject to a 10 IRS early withdrawal penalty. A fixed percentage not less than 5 nor more than 50 of the net fair market value of the assets is paid to one or more non-charitable beneficiaries who. If the CRAT were funded with 1.

The gift annuity surveys conducted by the ACGA are the best source of information about charitable gift annuity policies practices and trends. Reduce income taxes now through a charitable income tax deduction. How to Join or Support the ACGA.

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. The amount of the income stream is. At the end of 10 years the remaining CLAT assets totaling 1947000 are distributed to Janes descendants.

Can I Donate Stock to. The Charitable Remainder Annuity Trust or CRAT pays a fixed income stream to the taxpayer that is based on a taxpayer chosen percentage of the fair market value of the asset or assets gifted to the CRAT on the date of the initial gift. 1505 Ordinary and Necessary Business Expenses.

The other portion is viewed as an investment for you which ultimately generates. The IRS deducts from that value the amount of income youre likely to receive from the property. Eliminate capital gains when assets are eventually sold.

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Hampshire College

Charitable Gift Annuities Road Scholar

Charitable Gift Annuity Deferred University Of Virginia School Of Law

What Is A Charitable Gift Annuity Actors Fund

Charitable Gift Annuities Preachers Aid Society And Benefit Fund

Charitable Gift Annuities The Field Museum

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuities Studentreach

Charitable Gift Annuity Tprf Org

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Case Study Utilizing Gift Annuities To Help Older Donors Provide For Future Needs Planned Giving Design Center