is a contribution to a political campaign tax deductible

Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. The rules are the same for donations of both money and time.

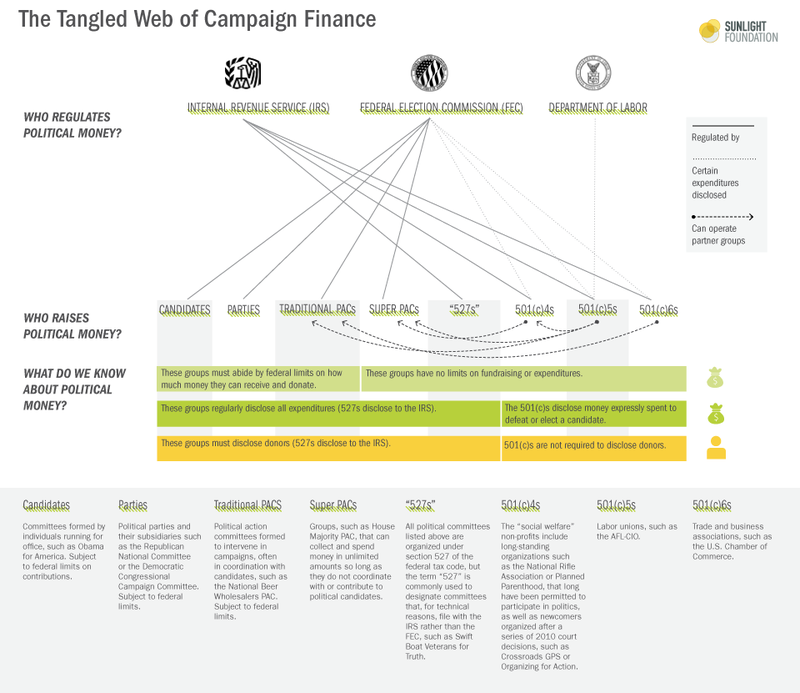

Campaign Finance In The United States Wikipedia

Among those not liable for tax deductions are political campaign donations.

. In other words you have. The IRS has clarified tax-deductible assets. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on.

To put it another way financial donations to political campaigns are not tax deductible. Any time you donate to a political candidate political campaign or political action committee. Advertisements in convention bulletins and.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. The answer is no political contributions are not tax deductible. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

Election season is right around the corner and you might be wondering if the money that you contribute to a political campaign can be deducted from your taxes. Come tax time accountants and tax preparers are often asked Are political contributions tax deductible Unfortunately people are often surprised by the answer which. Generally individuals cant deduct business entertainment expenses until the 2026.

It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Advertisements in convention bulletins and admissions to. In most states you cant deduct political contributions but four states do allow a tax break for political campaign.

Many believe this rumor to be true but contrary to popular belief the answer is no. Are Political Contributions Tax-Deductible. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

You can only claim deductions for. In 2022 an individual may donate. According to the Internal Service Review IRS The IRS Publication 529states.

So the answer is no. The IRS states You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Tax Bill Could Offer New Way To Funnel Political Cash And Make It Tax Deducti Npr

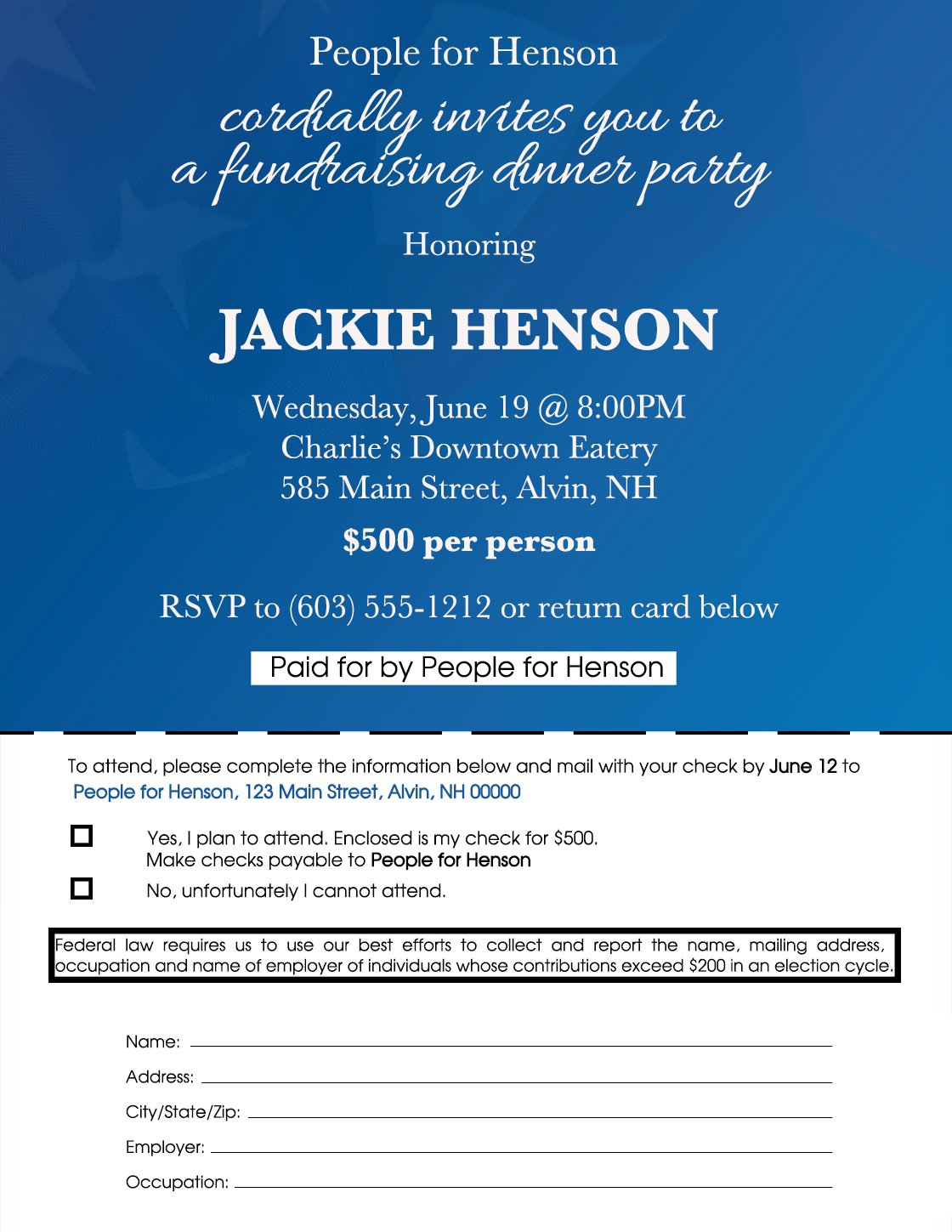

Candidate Committee Fundraiser Invitation Example

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

![]()

Are Church Donations Tax Deductible Tithe Ly

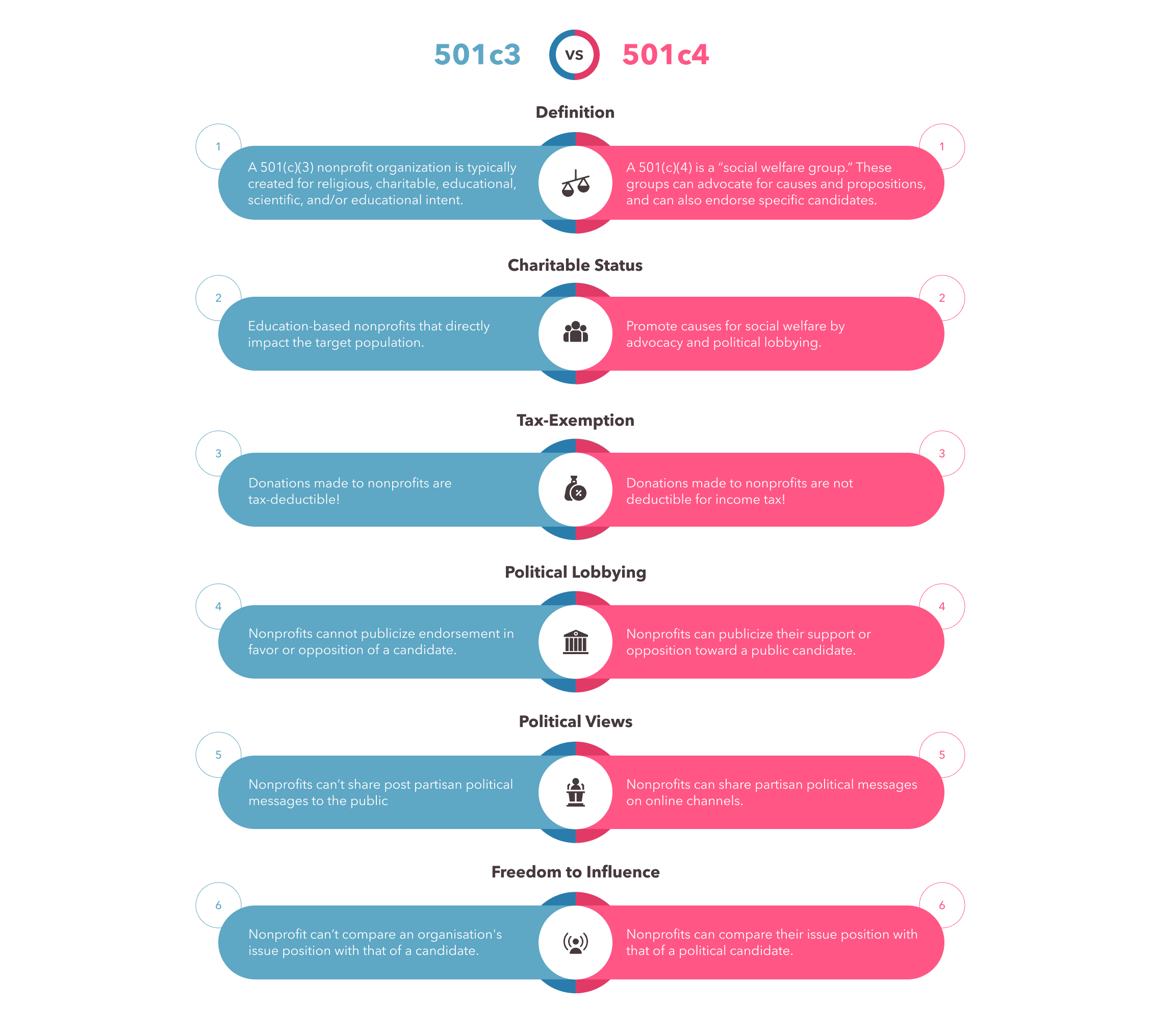

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Get Involved Flynn For Selectman

Free Political Campaign Donation Receipt Word Pdf Eforms

Pro Trump Group Falsely Claims Donations Are Tax Deductible

Are Political Donations Tax Deductible

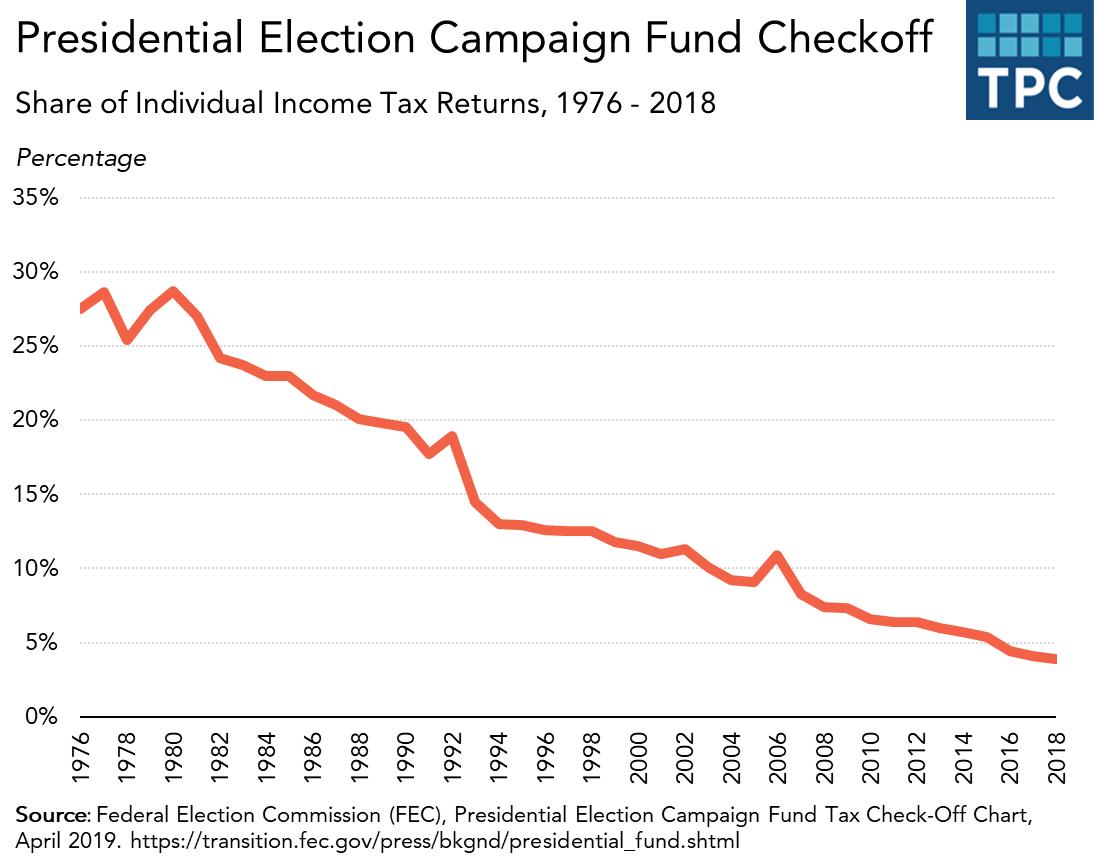

Rethinking The Presidential Election Campaign Fund Tax Policy Center

A Quick Guide To Deducting Your Donations Charity Navigator

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

You Re Invited Campaign Kickoff For Eric F Gilbert For Palmetto City Commissioner

Are Campaign Donations Tax Deductible Priortax

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog